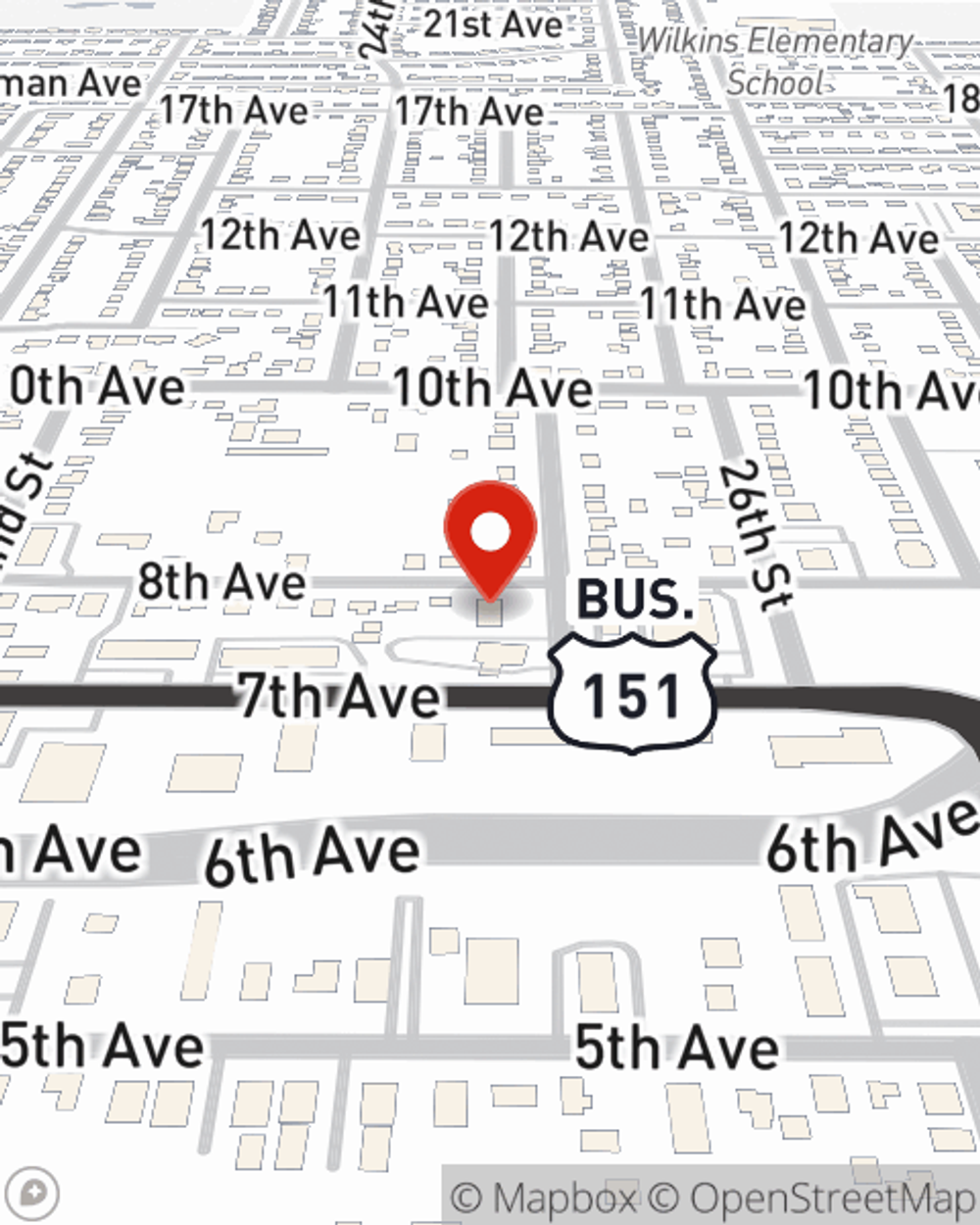

Life Insurance in and around Marion

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Anamosa

- Central City

- Robins

- Marion

- Cedar Rapids

- Center Point

- Urbana

- Hiawatha

- Benton County

- Johnson County

- Linn County

- Mount Vernon

- Shellsburg

- Springville

- Atkins

- Fairfax

Your Life Insurance Search Is Over

When you're young and your life is ahead of you, you may think you should wait until you're older to get Life insurance. But it's a good time to start talking about Life insurance to prepare for the unexpected.

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Love Well With Life Insurance

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with level or flexible payments with coverage to last a lifetime coverage for a specific time frame or another coverage option, State Farm agent Michelle Havener can help you with a policy that can help protect your loved ones.

If you're a person, life insurance is for you. Agent Michelle Havener would love to help you discover the variety of coverage options that State Farm offers and help you get a policy that's right for you and your children. Visit Michelle Havener's office to get started.

Have More Questions About Life Insurance?

Call Michelle at (319) 373-6730 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Michelle Havener

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.