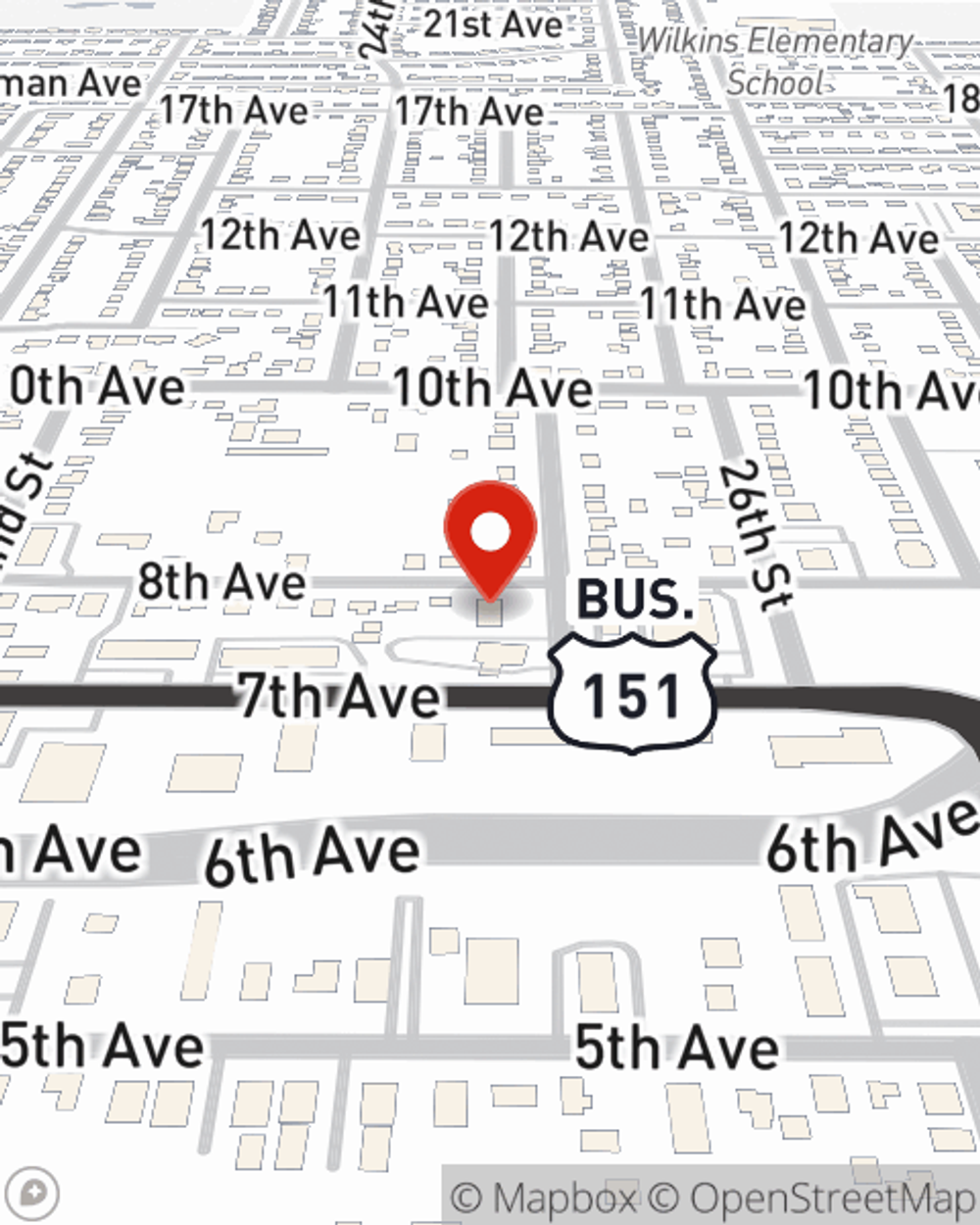

Renters Insurance in and around Marion

Looking for renters insurance in Marion?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Anamosa

- Central City

- Robins

- Marion

- Cedar Rapids

- Center Point

- Urbana

- Hiawatha

- Benton County

- Johnson County

- Linn County

- Mount Vernon

- Shellsburg

- Springville

- Atkins

- Fairfax

Home Is Where Your Heart Is

Your rented house is home. Since that is where you relax and kick your feet up, it can be a wise idea to make sure you have renters insurance, whether or not your landlord requires it. Even for stuff like your craft supplies, clothing, tools, etc., choosing the right coverage can make sure your stuff has protection.

Looking for renters insurance in Marion?

Coverage for what's yours, in your rented home

Open The Door To Renters Insurance With State Farm

It's likely that your landlord's insurance only covers the structure of the condo or apartment you're renting. So, if you want to protect your valuables - such as a coffee maker, a recliner or a guitar - renters insurance is what you're looking for. State Farm agent Michelle Havener wants to help you understand your coverage options and protect yourself from the unexpected.

A good next step when renting a condominium in Marion, IA is to make sure that you're properly insured. That's why you should consider renters coverage options from State Farm! Call or go online today and see how State Farm agent Michelle Havener can help meet your renters insurance needs.

Have More Questions About Renters Insurance?

Call Michelle at (319) 373-6730 or visit our FAQ page.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Michelle Havener

State Farm® Insurance AgentSimple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.